Table of Content

Easy Home is a completely interest free solution to your home financing needs. Unlike a conventional house loan, Meezan Bank’s Easy Home works through the Diminishing Musharakah where you participate with Meezan Bank in joint ownership of your property. The nature of the contract is co-ownership and not a loan. This is because the transaction is not based on lending and borrowing of money but on joint ownership of a house.

Once a significant chunk has been paid down, they might be able to buy the property outright with cash. Under the Sharia law of Islam, the payment or receipt of riba is prohibited, and thus a conventional mortgage that charges interest each month cannot be utilized by a practicing Muslim. Finder.com.au has access to track details from the product issuers listed on our sites. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. An Islamic home loans are offered as full-documentation products.

Reader Comments

Your payments to Meezan Bank are hence completely Riba-Free. Meezan Bank’s Easy Home works through Diminishing Musharakah and conforms to Shariah laws specifically related to financing, ownership and trade. The nature of the contract is co-ownership and not a loan because the transaction is not based on lending and borrowing of money but on joint ownership in a house. Creating joint ownership and then gradually transferring ownership to the consumer instead of simply lending money is the major factor that makes Easy Home Shariah-compliant. Meezan Bank’s Easy Home works through the Diminishing Musharakh and conforms to Shariah laws specifically related to financing, ownership and trade.

Your lending institution may approve your circumstance beforehand, allowing you to immediately choose a home that is within the price range they agreed upon, thereby facilitating your application process. The property he'd like to purchase is valued at $310,000 and with his $60,000 deposit, he needs help coming up with the $250,000 difference before the house can be transferred to him. With around 1.7% of the Australian population being Muslim, there are limited Sharia-compliant home finance programmes on the market. Islamic home loans are available for many purposes such as construction and purchasing vacant land, although they are not typically used for refinancing. They also come in full documentation and low documentation versions, depending on your leasing needs.

Use our Calculator to Determine your Payment Plan!

These renowned experts were actively engaged in the design of our home financing program, and they remain involved in its ongoing oversight. Guidance Residential’s purpose for existing is to provide a halal alternative to a conventional home loan for faith-conscious American families. At no point does the property itself come onto the balance sheet of the bank. Some contemporary scholars have permitted this riba-based transaction if it is in a non-Muslim country and it is done in order to acquire a house in which to live. This permission is attributed to the Hanafi madhhab, and some evidence is quoted for it. But many scholars have challenged this fatwa , including Shaykh Salah as-Saawi in his book Waqafat Hadiah ma‘a Fatwa Ibahat al-Qurud al-Ribawiyyah li Tamwil Shira al-Masakin fi’l-Mujtama‘at al-Gharbiyyah.

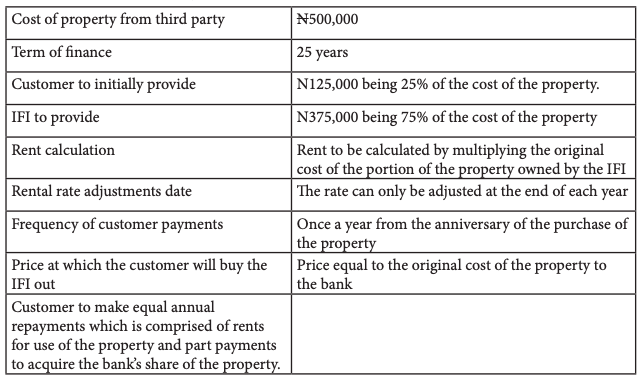

This concept means you and the bank join in a partnership to buying the property. The bank buy the property and leases the property back to you at an agreed rental price which includes profit component of the bank. Progressively lower its shareholding over time and you will own the property in the end.

Easy Home - Islamic House Finance

It is a completely new financing model based on the concepts of partnership and co-ownership. While the structure is not the same as a traditional mortgage, the costs are comparable. Any financing in the United States must also follow federal, state, and local rules and regulations.

Sharia-compliant banks have been experiencing a period of rapid growth, especially in the non-Muslim-majority world. Sharia-compliant services are also offered by some conventional banks, and the Bank of England in the UK is currently consulting on the issue. You may approach any of the Islamic banking institutions listed above that offer Sharia-compliant products to know your options.

These loans let you borrow money for any purpose, and they tend to come with fairly competitive interest rates. Mortgage my property and took loan from Islamic bank it covers full loan for business. I can’t repay loan bank sue against me criminal case, civil case now my question is that if i cover my loan by giving mortgage which cover entire loan how can bank sue against me? How i can get relief in the eye of sharia law Mortgage please let me know the solution.

Under a partnership financing structure, the bank and the person who buys the home are partners in the property purchase. This is an all-equity transaction and without using any debt. The home buyer’s down payment is their equity stake in the venture, and the bank’s financing is their equity stake.

For instance, if the home price is $300,000, the purchaser puts down 10 percent, or $30,000; the bank would “invest” $380,000 and own 90 percent of the home, with the financing period of 30 years. We live in a western society and we live in rented accommodation so as to avoid riba. Recently, we found out that there are no houses for rent, and 96% of the market is based on mortgages. Be aware that some of the terminology used in the material on Islamic home financing may resemble that used in traditional mortgages, such as the term “rates.” That does not mean that it’s not halal. Islamic home financing must comply with government regulations, and it may be structured in a way that makes it easy for customers to compare with traditional options. What you are checking is the underlying structure and foundation.

Some scholars have stated that extenuating circumstances may make it permissible if it’s unavoidable. So the banking world is not in the business of buying assets. It is in the business of financing projects and assets and making sure the loan is backed up by some form of safety for itself in case of default. That usually means either foreclosing on the valuable security that it has been granted or going after the debtor for the money . Many Muslims have started using Islamic mortgages in the UK .

Some argue that Islamic finance simply interchanges terminology and concepts and that Sharia-compliant home loans don’t differ greatly from standard home loans. This is because they believe that both Islamic and conventional banks make the same return, except conventional banks label it "interest" while Islamic institutions label it "profit". However, you must consider additional concepts such as risk-sharing and the absence of ambiguity which make Islamic home loans unique, compared to traditional loan products. On this subject, Murphy states, “In Australia, the Muslim community comprises Pakistanis, Fijians, Indians, Malaysians, Egyptians and so on. It would not be uncommon for some people to come to me and say ‘I want my Imam to sign off on your program’.

Better still, you enlist the services of a mortgage broker who can best help you find a suitable financing. With an Islamic home loan, you can choose the home and then the financial institution will buy it from the seller. This same financial institution then agrees to lease the home for a pre-determined period, which is known as Ijarah Muntahiyah Bittamlik. At the time of the final lease payment, ownership of the home will be transferred to you in the form of a promissory gift or hiba. The question as worded in the title is misleading, because our home financing isn’t a “mortgage loan” at all. There are some external similarities between Islamic home financing and a mortgage loan, but in reality they are based on completely different foundations.

Things That Invalidate Divorce in Islam You...

But as we all know, many Muslims continue to use conventional mortgages despite the prohibition on interest in Islam. Some of these Muslims argue that in fact conventional mortgages are halal. So now we talk about another type of loan from the bank you can use while buying the house. Non-conventional or Islamic banks grant interest-free loans called goodly loans, or in simple language, it is called qard-e-hasna. You have to return the actual amount of the loan, neither less nor more. Personal loans are unsecured, so they're not tied to a specific asset.

In Islamic law, there is no prohibition to get any loans and debt as long as it followed by Islamic Syariah. That is why you need to be careful before take any decision to get some loans or debt to support your online business from Islam perspective. When you take a loan from a conventional bank, they give you the loan on an interest basis, or you can say they give you the loan on the Riba system. You have to provide them with the fixed rate of interest for the whole period of the loan or the entire age of the loan.

No comments:

Post a Comment